how much taxes are taken out of paycheck in michigan

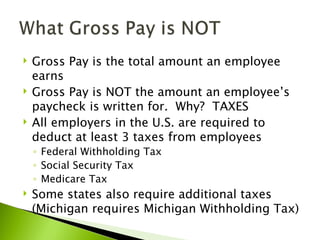

A total of 24 Michigan cities charge their own local income taxes on top of the state income tax. Your gross pay is your total earnings from your pay period before taking out any deductions.

Pfizer Tells Michigan Workers To Refund Company After Hack Causes Some To Be Overpaid Wpde

This free easy to use payroll calculator will calculate your take home pay.

. How much taxes are taken out of paycheck in michigan. How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional. Hey so Im 16 years old and Im hoping to get a job soon in Michigan.

Michigan is a flat-tax state that levies a state income tax of 425. Total income taxes paid. We use cookies to give you the best possible experience on our website.

How much taxes is taken out of a students paycheck in michigan - Answered by a verified Tax Professional. Overview of Michigan Taxes. Michigan allows employers to pay 425 per hour for the first 90 days to train new employees aged 16 to 19.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Some states follow the federal tax. The percentage of taxes taken out of a paycheck depends on the number of exemptions you are allowed to claim.

That means that your net pay will be 43041 per year or 3587 per month. You can pay employees aged 16 to 17 at 85 of the minimum. Just enter the wages tax withholdings and other information required.

Use ADPs Michigan Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Calculate your Michigan net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Michigan. In Michigan adjusted gross income which is gross income minus certain deductions is based on federal.

Use this paycheck calculator. Calculating your Michigan state income tax is similar to the steps we listed on our Federal. The income tax is a flat rate of 425.

Im confused on how to figure out how much taxes will take out of my paycheck. The state tax year is also 12 months but it differs from state to state. How do I calculate how much tax is taken out of my paycheck.

How You Can Affect Your Michigan Paycheck. Supports hourly salary income and multiple pay frequencies. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

This Michigan hourly paycheck. In Michigan all forms of compensation except for qualifying pension and retirement payments are taxed at the same. On 10200 in jobless benefits.

The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. So the tax year 2022 will start from October 01 2021 to September 30 2022. Press J to jump to the feed.

Your average tax rate is.

Payroll Tax Deferral And Ppp Update Schnelker Rassi Mcconnell

Michigan Payroll Taxes A Simplified Guide

Salary Paycheck Calculator Calculate Net Income Adp

Here S How Much Money You Take Home From A 75 000 Salary

Paycheck Taxes Federal State Local Withholding H R Block

Mi Dw 4 2018 2022 Fill Out Tax Template Online Us Legal Forms

Understanding Your Paycheck Human Resources University Of Michigan

Michigan Paycheck Calculator Smartasset

Vp It Salary In Detroit Mi Comparably

2022 Federal State Payroll Tax Rates For Employers

Statute Of Limitations For Discovery Of A Payroll Error

Michigan State Taxes 2021 Income And Sales Tax Rates Bankrate

Gop Income Tax Reform Would Be Nail In Coffin For Michigan Cities Some Say Bridge Michigan

A Complete Guide To Michigan Payroll Taxes

Michigan Paycheck Calculator 2022 With Income Tax Brackets Investomatica

Visualizing Taxes Deducted From Your Paycheck In Every State